BANK OF CANADA SIGNALS PEAK RATES BUT UNDERLYING PRICE PRESSURE REMAINS

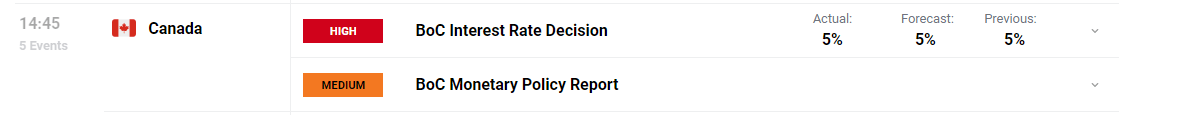

Yesterday the Bank of Canada (BoC) kept rates unchanged in line with broad expectations. However, the bank did signal that interest rates have peaked via a change in the wording of the January 24th statement. The committee decided to move away from prior wording which alluded to whether monetary policy is restrictive enough, to wording around how long the current level of interest rates ought to remain to ensure a return to the price target.

The statement also highlighted the persistent price pressures captured within the core measure of inflation, mainly the effects of elevated wages, shelter but also mentioned elevated food prices which is picked up in the headline measure of inflation.

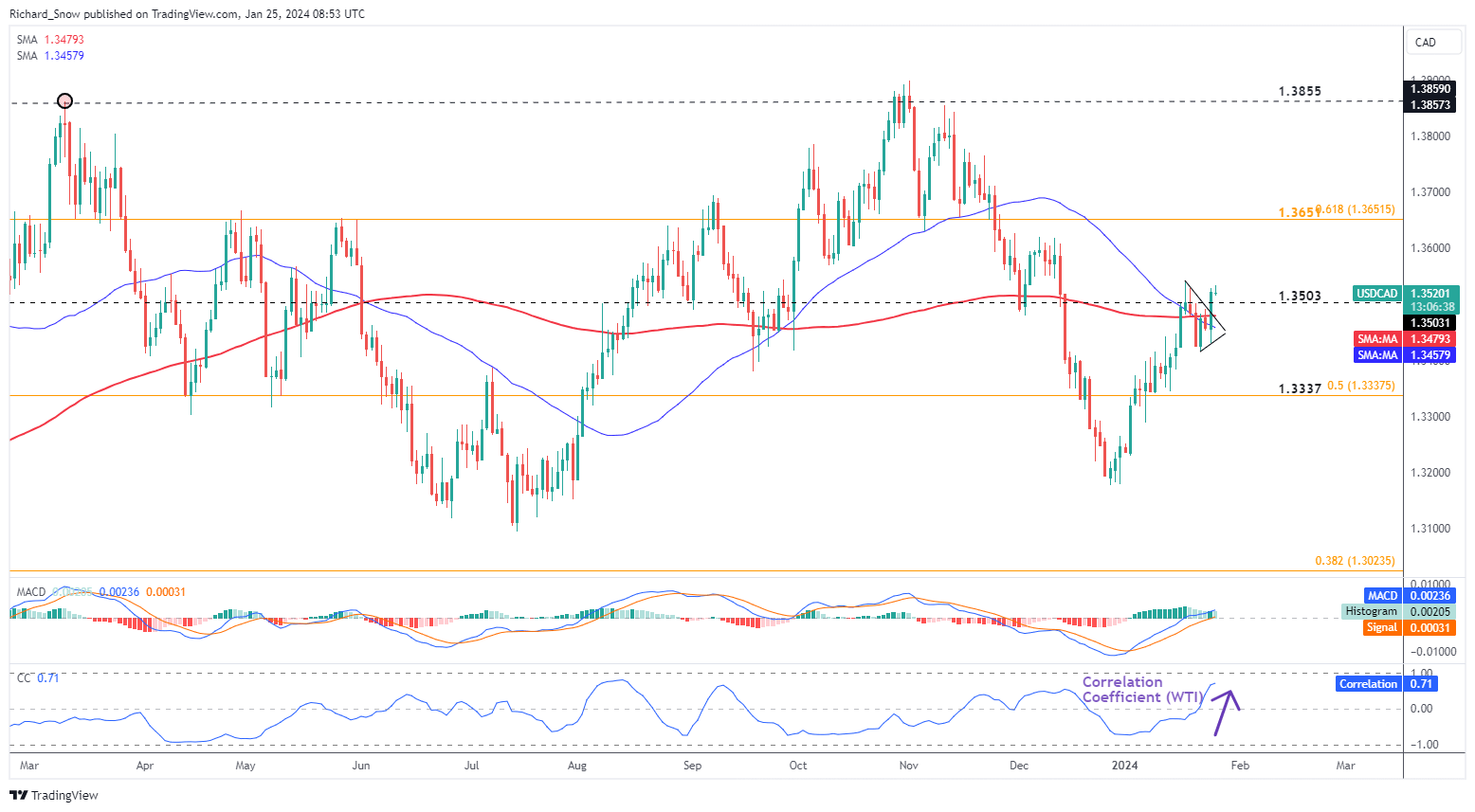

USD/CAD BULLISH PENNANT HINTS AT TREND CONTINUATION

USD/CAD appears to favor a bullish continuation after yesterday's CAD weakness in light of the dovish shift from the Bank of Canada. As long as price action holds above 1.3503, The bullish move remains constructive and is backed up via the MACD indicator which shows no clear signs of a reversal in momentum. For context, the usual negative relationship between USD/CAD and WTI oil prices has weakened (see correlation coefficient indicator in blue at the bottom of the chart) in the short to medium-term meaning any rise in oil prices is unlikely to contribute significantly to strengthen the Canadian Dollar.

Trade is understandably light ahead of the New York session but could see momentum return around the release of Q4 GDP data for the US later today. Immediate support appears at 1.3503 with resistance coming in at the 61.8% Fibonacci level of the major 2021 to 2021 decline (1.351). US GDP data is expected to moderate to a more sustainable 2% level, down from the outstanding Q3 statistic of 4.9%.

USD/CAD Daily Chart

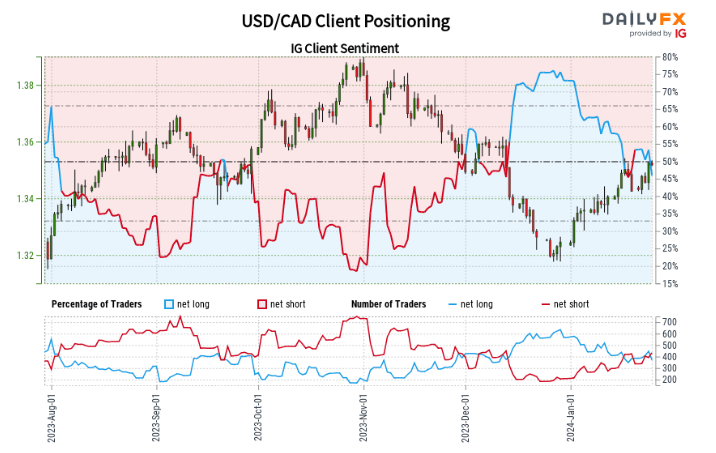

IG CLIENT SENTIMENT FAVOURS TREND CONTINUATION AS TRADERS PILE INTO SHORTS

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bullish contrarian trading bias.